san francisco gross receipts tax apportionment

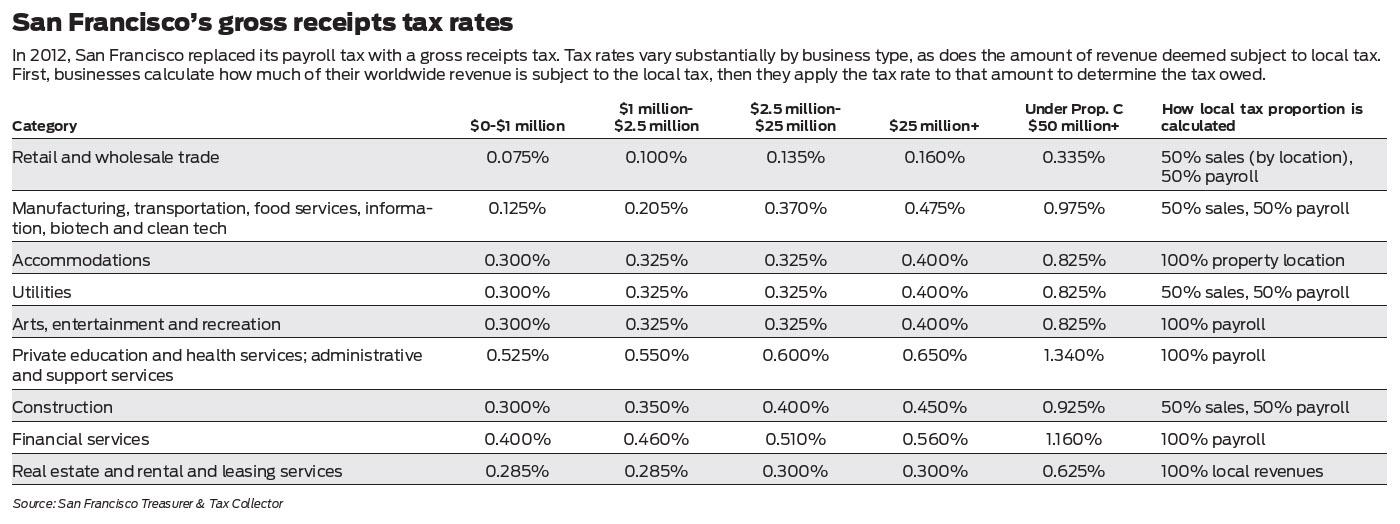

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. The City began making the transition to a Gross Receipts Tax from a Payroll.

San Francisco Gross Receipts Tax Clarification

For the 2020 tax year non-exempt taxpayers engaging in business within the City that had more than 1200000 of combined taxable San Francisco gross receipts are generally.

. 1 This gross receipts tax will gradually. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B15. Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll.

All persons deriving gross receipts from business activities both within and outside the City shall allocate andor apportion their gross receipts to the City using the rules set forth in Section. D For tax year 2024 if the Controller certifies under Section 95310 that the 95 gross receipts threshold has been met for tax year 2024 and for tax years beginning on or after January 1. San Francisco Gross Receipts Tax B14.

The voters of San Francisco the City recently approved Proposition E a gross receipts tax that will be phased in over five years beginning in 2014.

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

Working From Home Can Save On Gross Receipts Taxes Grt Topia

State Local Tax Manager Resume Samples Velvet Jobs

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

A New Dimension For Llcs In California

State Tax Update The Shift From Cost Of Performance To Market Based Sourcing Marcum Llp Accountants And Advisors

Seattle And San Francisco Look To Recoup Revenues Lost During Covid 19

Texas Comptroller Revisions Dallas Business Income Tax Services

Gross Receipts Tax And Payroll Expense Tax Sfgov

Cost Of Performance Vs Market Based Tax Apportionment Explained Fusion Cpa I Tax Accounting Netsuite Consulting Services

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

Annual Business Tax Returns 2020 Treasurer Tax Collector

The Purpose Of The Sales Factor Is To Reflect Market Sales To The State Where Those Sales Are Made Pdf Free Download

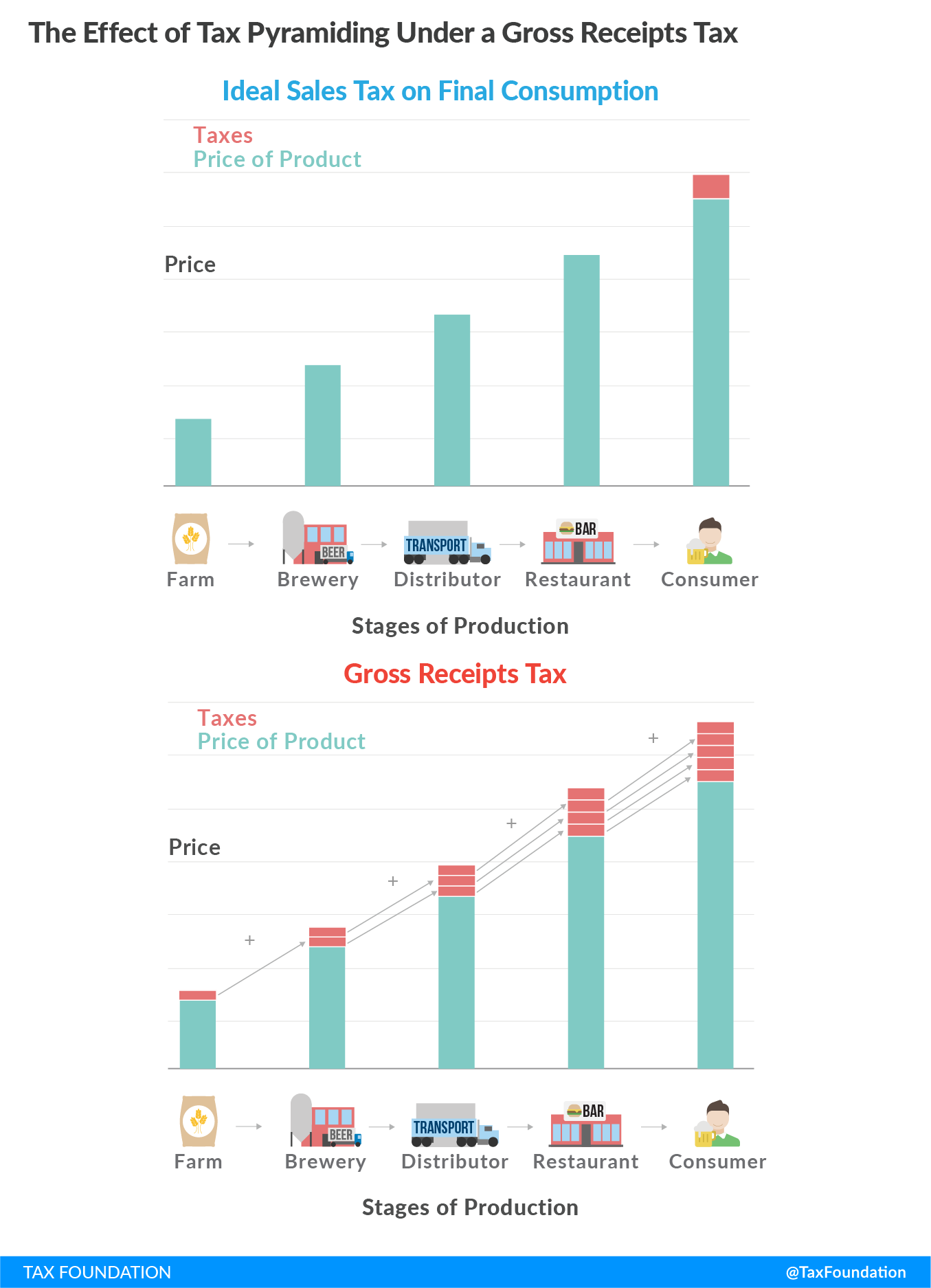

Gross Receipts Taxes Are Making A Dangerous Comeback Tax Foundation

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

San Francisco Gross Receipts Tax

Gross Receipts Taxes An Assessment Of Their Costs And Consequences